Avenue Living’s strategic approach and milestones from the past year continue to support our business expansion across North America.

Avenue Living Asset Management reached a number of significant milestones in 2021. Despite the ongoing pandemic and challenges facing the world today, our robust investments in workforce housing, self-storage, and agricultural properties — on both sides of the border — grew our total assets under management to over $3.1 billion, more than doubling in value in under 1.5 years.

Throughout the year, Avenue Living focused strategically on two key areas of our business to drive greater customer satisfaction — our platform and our service model. “Like healthy soil, when you start with a solid foundation, anything you plant in it will grow,” says Anthony Giuffre, CEO of Avenue Living. “This is why we focus on investing in our people while optimizing and refining our end-to-end customer service model. For us, it was vital to have these two important elements in place before expanding our assets under management.”

“During the last two years we’ve had to navigate numerous waves of COVID-19 and changing public health restrictions — and through that process, we’ve constantly adapted,” says Anthony. “When housing 30,000 people and serving a diverse set of customers, it’s essential to understand their specific needs. To cater to these unique needs, we had to make our operations as fluid and functional as possible to ensure a high level of customer satisfaction. I would say our team did that exceptionally well in 2021.”

With the addition of more than 2,800 multi-family apartment units, 6,600 acres of farmland, and 1,750,000 square feet of storage units last year alone, Avenue Living continued to fortify our position as a leading multi-family owner/operator in Canada, along with a growing presence in the self-storage, agriculture, and U.S. multi-family spaces.

Avenue Living’s portfolio now includes over 13,000 multi-residential units, over 2 million square feet of self-storage property space and 48,000 acres of agricultural real estate — and we anticipate significant growth in 2022 with our Core Trust’s acquisition of our U.S. Real Estate Trust, moving us towards a more holistic North American investment focus with a large pipeline of potential assets.

“We’ve now created a more institutionalized and robust platform for our business,” says Anthony. “Our well-defined processes, technological advancement, and clear objectives differentiate us. In addition to having a laser-focused acquisition strategy for workforce housing assets, we have prioritized our overall customer experience, which is key to our continued success.”

Below are some of our most important milestones and achievements from last year, all of which set us up for a strong start to 2022.

The Avenue Living Team Passes 750 Employees Strong

Our team welcomed a record number of new colleagues last year; now totaling 750 employees within the company and across North America. These experts are the backbone of our platform and one of the main reasons we have been able to achieve such sustained growth.

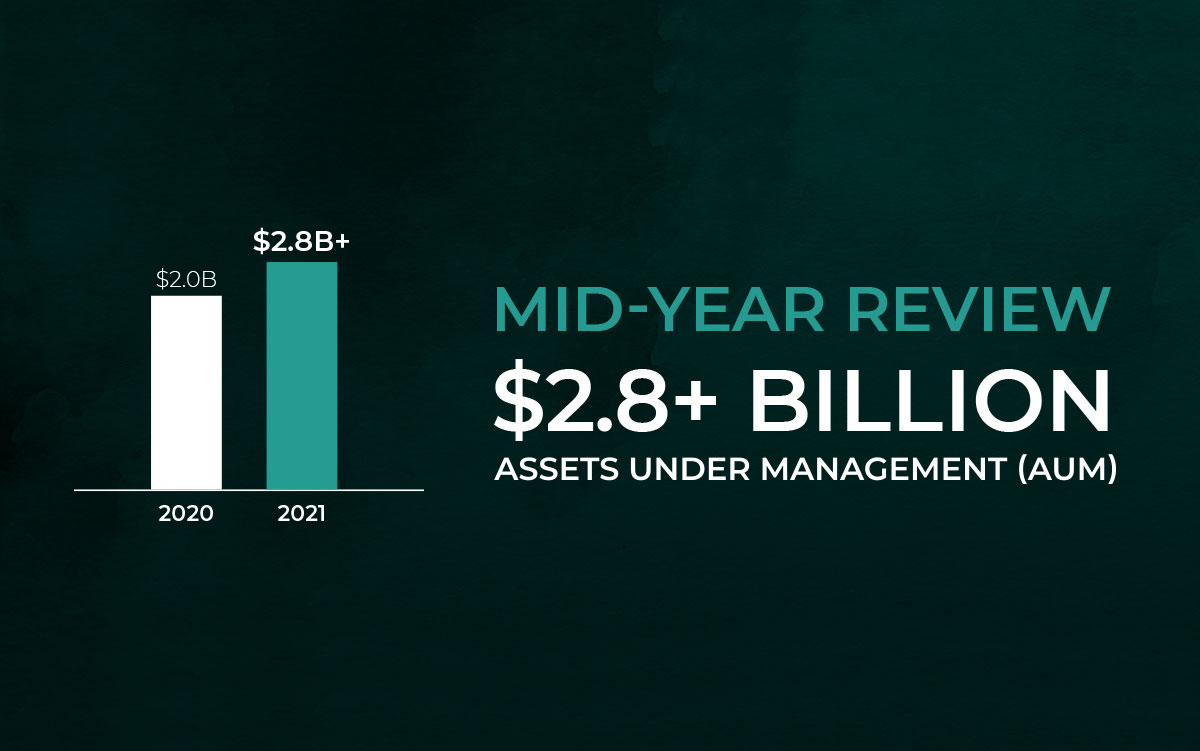

Assets Under Management Grow to $3.1 Billion

Avenue Living reached a major benchmark earlier this year as the company surpassed more than $3.1 billion in assets under management. This is a significant achievement and shows incredible growth as the total amount of AUM doubled from $1.5 billion to $3.1 billion in less than 1.5 years.

Avenue Living Joins Principles for Responsible Investment

We were honoured and proud to announce that Avenue Living became a signatory of the Principles for Responsible Investment (PRI), the world’s leading proponent of responsible investment. The PRI framework encourages investors to use responsible investment to enhance returns and better manage risks and is supported by the United Nations. We are pleased to be among the 218 global organizations that became new signatories in 2021. The PRI now has 4,375 signatories, representing US$121 trillion of AUM. As PRI signatories, we ensure that as we grow, we do so responsibly.

MMSP Trust Establishes U.S. Footprint

Mini Mall Storage Properties Trust acquired its first storage property south of the border in December 2021. Located in Arkansas, this property is the beginning of an expansion into the American Heartland, where we will continue to move into attractive secondary markets under the leadership of our new President of U.S. Operations.

Avenue Living Creates First North American Workforce Housing Fund

Our U.S.-focused Trust, which was established in February 2020 and exclusively held multi-family properties in the United States, reached the $100 million AUM mark in 2021. The Trust’s success demonstrates the defensibility of our investment strategy and the value our U.S. expansion brought to the Avenue Living portfolio. On the strength of this growth, Avenue Living Core Trust acquired 100 per cent ownership of the U.S. Real Estate Trust, and its U.S. assets. This alignment created the first North American Workforce Housing Fund, offering further diversification to investors by operating across a broader geographic platform while continuing to specialize in what we do best.

Poised for Continued Growth in 2022

With a clear focus on Avenue Living’s pillars of success and key investment strategies, we have achieved many pivotal milestones in 2021. These foundational elements have become the framework for us to continue our expansion and growth into 2022.

This commentary and the information contained herein are for educational and informational purposes only and do not constitute an offer to sell, or a solicitation of an offer to buy any securities or related financial instruments. This article may contain forward-looking statements. Readers should refer to information contained on our website at www.alamstg.wpenginepowered.com for additional information regarding forward-looking statements and certain risks associated with them.