Multi-family real estate has long been recognized as one of the best ways to hedge against inflation. Property classes reflect an A, B, or C grade based on a combination of factors such as amenities, management styles, location, and tenant income levels. However, the best bets aren’t always shiny new Class A properties in hot housing markets with high rents. Avenue Living Asset Management holds B and C multi-family real estate assets and has a tried-and-true track record of providing A-class institutional quality management through customer-centric operations and services, capital improvements and a vertical integration model.

Designed For Defence

Avenue Living Combines Funds, Plans ‘Workforce Housing’ Growth

The Avenue Living Core Trust has recently closed on the acquisition of the Avenue Living U.S. Real Estate Trust. This transaction, along with the execution of further pipeline opportunities in Canada and the U.S., brings our Core Trust to 22 markets across North America, and a current total AUM of $2.4 billion representing 12,387 multi-family units across North America.

By creating what we view to be the first North American alternative real estate fund specializing in workforce housing, we have established a platform for efficient expansion of the Trust’s multi-family real estate consolidation across the North American Heartland.

https://renx.ca/avenue-living-combine-funds-plan-major-residential-growth/

This commentary and the information contained herein are for educational and informational purposes only and do not constitute an offer to sell, or a solicitation of an offer to buy any securities or related financial instruments. This article may contain forward-looking statements. Readers should refer to information contained on our website at www.alamstg.wpenginepowered.com for additional information regarding forward-looking statements and certain risks associated with them.

Avenue Living’s Strategic U.S. Expansion

As Avenue Living marks 15 years of success, and our Core Trust celebrates four years as an alternative product, we are now looking at our next steps.

The Avenue Living Core Trust is entering the U.S. Heartland and this article by Wealth Professional outlines just how our expanded strategy builds on a strong track record and considers our customers and investors first.

This commentary and the information contained herein are for educational and informational purposes only and do not constitute an offer to sell, or a solicitation of an offer to buy any securities or related financial instruments. This article may contain forward-looking statements. Readers should refer to information contained on our website at www.alamstg.wpenginepowered.com for additional information regarding forward-looking statements and certain risks associated with them.

Calgary-based Avenue Living continues rapid growth despite pandemic challenges

We’re proud of our Alberta roots. We’ve always seen opportunity in the province we call home, and our success here is an example of how our proven strategy — focusing on markets with strong fundamentals and investing in the “everyday” — has served us well at home and in markets across Canada and the United States.

This commentary and the information contained herein are for educational and informational purposes only and do not constitute an offer to sell, or a solicitation of an offer to buy any securities or related financial instruments. This article may contain forward-looking statements. Readers should refer to information contained on our website at www.alamstg.wpenginepowered.com for additional information regarding forward-looking statements and certain risks associated with them.

Housing affordability should be at the forefront of many discussions: Avenue Living CEO

Avenue Living Founder and CEO Anthony Giuffre joined Greg Bonnell at BNN Bloomberg to discuss our outlook on the real estate market and navigating through the pandemic.

“We stick with the fundamentals. We’re seeing a massive transition of wealth — or a ‘changing of the guard,’ with the old guard looking for liquidity, and platforms like ourselves have the ability to continue to provide value-add in that space.”

To see the full interview, click here: Housing affordability should be at the forefront of many discussions: Avenue Living CEO – Video – BNN (bnnbloomberg.ca)

This commentary and the information contained herein are for educational and informational purposes only and do not constitute an offer to sell, or a solicitation of an offer to buy any securities or related financial instruments. This article may contain forward-looking statements. Readers should refer to information contained on our website at www.alamstg.wpenginepowered.com for additional information regarding forward-looking statements and certain risks associated with them.

Investing In the Everyday — Business In Calgary Magazine

Avenue Living Founder and CEO, Anthony Giuffre is on the September cover of Business in Calgary Magazine. He is featured in the story ‘Investing in the Everyday’, where he talks about Avenue Living’s continued success, and how our strategic investment platform has enabled us to become one of Western Canada’s largest private real estate owner/operators.

This commentary and the information contained herein are for educational and informational purposes only and do not constitute an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This article may contain forward-looking statements. Readers should refer to information contained on our website at www.alamstg.wpenginepowered.com for additional information regarding forward-looking statements and certain risks associated with them.

Interview with BNN Bloomberg: How Avenue Living is giving investors a new way to get into real estate

When people hear the words “real estate investing,” they think of buying assets themselves or purchasing stocks in real estate investment trusts (REITs) that trade on the exchanges where prices are set by a secondary market. Since 2006, our CEO, Anthony Giuffre, has championed other ways to take into this market — through investment funds that both own and operate real estate.

Anthony spoke with BNN Bloomberg about the state of business and navigating a tumultuous pandemic. Read the interview at BNN:

This commentary and the information contained herein are for educational and informational purposes only and do not constitute an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This article may contain forward-looking statements. Readers should refer to information contained on our website at www.alamstg.wpenginepowered.com for additional information regarding forward-looking statements and certain risks associated with them.

Keynote Interview with PERE: Secondary Markets Poised for Growth

CEO of our U.S. Real Estate Trust, David Smith, participated in a keynote interview with PERE. Gain more insight into why David believes the COVID-19 pandemic brought opportunities in secondary markets to the forefront, while at the same time kickstarting a shift in renter expectations for a higher standard of living.

This commentary and the information contained herein are for educational and informational purposes only and do not constitute an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This article may contain forward-looking statements. Readers should refer to information contained on our website at www.alamstg.wpenginepowered.com for additional information regarding forward-looking statements and certain risks associated with them.

Finding Opportunity in the Everyday

Despite the difficult reality of the COVID-19 pandemic which created economic hardships across the globe, Avenue Living found a way to succeed.

Continue readingAnthony Giuffre’s 2021 Industry Outlook with BNN Bloomberg

CEO, Anthony Giuffre discusses Avenue Living’s commitment to investing in the everyday combined with a vertically integrated platform gives the company a competitive advantage within the multi-family real estate industry.

Continue readingJason Jogia: Avenue Calgary’s Top 40 Under 40

Calgary company with rental housing units in southern Saskatchewan help out local foodbanks

ON 620 CKRM THE SOURCE: The 16-and-a-half-thousand dollars being given by Avenue Living is part of an overall $100,000 donation that is being shared amongst 17 food banks or similar community organizations across the Prairies.

Continue readingAsset Manager Hits $1.5 Billion Milestone

The firm’s investment funds focus on real estate in the Prairies, with rapid growth ‘very validating.’ Read the coverage from Wealth Professional, Canada’s leading independent publication dedicated to financial planners and advice professionals.

Continue readingBrad Wall on BNN: The Year Ahead for Avenue Living

Brad Wall, Special Business Advisor to Avenue Living Asset Management and former Premier of Saskatchewan, talks to BNN Bloomberg host Greg Bonnell about the three parallel growth tracks ahead for Avenue Living in 2020. Watch the video:

Continue readingFeatured on BNN: Brad Wall discusses new role at Avenue Living

BNN Bloomberg’s Greg Bonnell, host of The Real Economy, speaks to Brad Wall about Avenue Living’s workforce housing strategy across the Prairies, with plans to expand into the United States.

Continue readingSimple Business Model Creates Billion Dollar Firm

Real Estate Magazine goes back to the beginning to get the breakdown on the Avenue Living Asset Management business model.

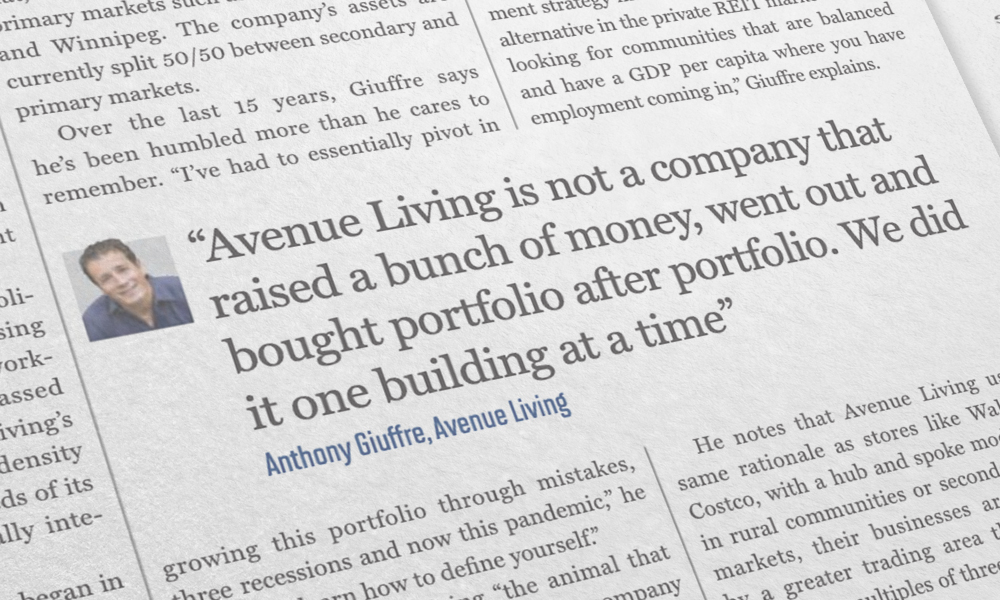

Continue reading“One building at a time” adds up big for Alberta company

In a seven-month period, Avenue Living Asset Management raised $130 Million, blowing past its forecast for the year and giving recognition to a homegrown Alberta investment company that has amassed $1.1 Billion in assets in just 12 years.

Continue readingAvenue Living Authors A Phenomenal Success Story

As reported by RENX, Calgary-based Avenue Living Asset Management began in 2006 with the purchase of 24 rental units in Brooks, AB, for $3 Million. From those modest …

Continue reading